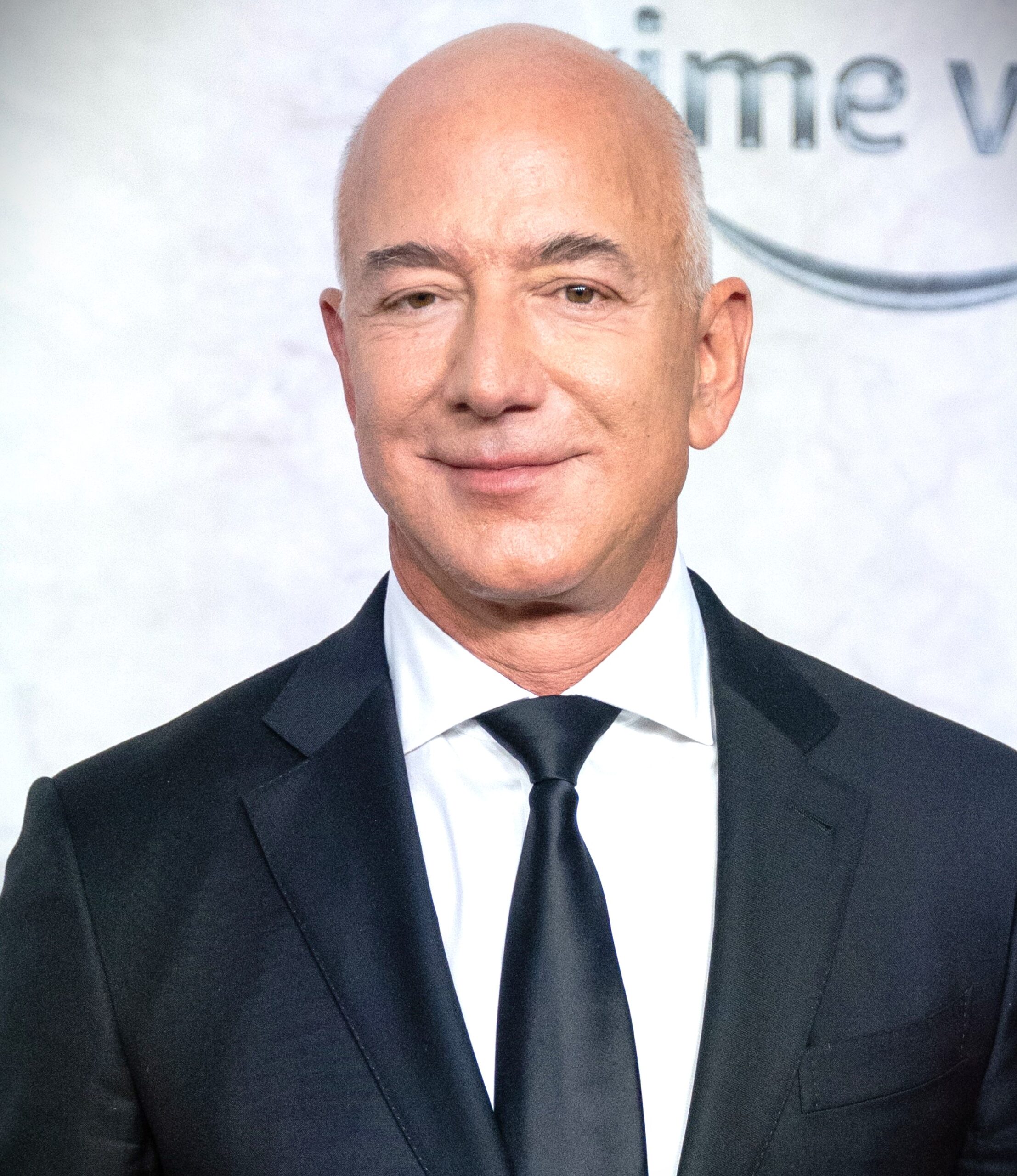

Jeff Bezos Biography | Amazon

Jeff Bezos Will Store $600M Stock Sale in Florida, Not Washington:

Amazon founder Jeff Bezos plans to sell 50 million shares of Amazon stock. For which he would have spent millions of dollars had he not moved from Washington state.

Bezos adopted a trading plan last November to sell 50 million shares of Amazon stock by a period ending January 31, 2025.

Bezos adopted the trading plan on Nov. 2, six days after announcing his move from Seattle to Miami, Fla.

Unlike Washington, Florida has no capital gains tax. In January 2022, Washington enacted a 7% tax on the sale of financial assets despite a legal challenge. Earlier in 2023, the state Supreme Court upheld the constitutionality of the capital gains tax.

While living in the Evergreen State, Bezos owed the state $70 million for every $1 billion he sold in Amazon stock.

Amazon is covering everything from the tech giant’s home town in depth, including e-commerce, AWS, Amazon Prime, Alexa :

Amazon stock is currently around $169 per share, meaning Bezos’ 50 million shares could be worth around $8.5 billion. Instead, Washington state stands to lose about $595 million in capital gains tax revenue from the Amazon founder alone.

Before the capital gains tax goes into effect in 2022, Bezos sold $8.8 billion worth of Amazon stock in 2021, according to Forbes. It would have raked in $616 million in capital gains tax revenue.

Center Square previously reported revenues of more than $889 million in its first year after taxes. Bezos sold his shares while in the state to Washington. Where $596 million was owed, 67% of the total tax revenue generated.

Revenue generated by the capital gains tax funds the Education Legacy Trust Account and the General School Construction Account. which funds early childhood education and general school programs.

A new AMA submitting, detailing Jeff Bezos’ plan to provide away a key stake inside the business enterprise, sheds new mild on his circulate from Seattle to Miami — and his ability to benefit from Washington kingdom in the process.

The filing shows that Amazon might also offer and electricity 202 may start buying and selling on Nov. 8 for fifty Amazon shares, up from the last trial on Jan. Eight. It is the primary time Amazon has stocked it considering the fact that 2021.

The plan came less than a week after Bezos announced on Instagram on Nov. 2 that he was leaving his longtime home of Seattle for the sunnier skies of Miami.

The plan was adopted less than a week after Bezos announced it on Instagram on November 2. He’s leaving his longtime home of Seattle for the sunny skies of Miami.

In the Instagram post, Bezos said he wanted to be closer to his parents and the Blue Origin space venture in Florida. He did not mention taxes.

But because of Bezos’ recent exit from Washington — where he established Amazon as a global behemoth. If he ends up selling the maximum 50 million shares under the plan, he will save about $600 million in tax costs. Current stock price of the company.

“Washington’s Capital Gains Tax: Balancing Revenue and Economic Impact”:

The capital gains tax passed in 2021 imposes a 7% tax on any gain over $250,000 from the sale of stocks and bonds, with some exceptions. It was challenged in court but ultimately ruled constitutional last year by the state Supreme Court. The tax brought in about $900 million in its first year of collection. Revenue goes toward primary education and child care programs as well as school construction projects.

Tax advocates say it’s a way to change Washington’s regressive tax laws to help low-wage earners. Opponents warned that the capital gains tax could cause businesses to leave the region.

Florida, like Washington state, has no income tax. It also has no capital gains tax.

Bezos controlled about 12.3% of the company’s outstanding stock as of a February 2023 proxy filing. He still has voting rights on the shares he owns outright and the shares owned by his ex-wife Mackenzie Scott. If he sold the maximum 50 million shares indicated by the filing, he would still control 11.8% of the company’s stock. That’s a decline of about half a percentage point.

“Bezos’ Amazon Stock Sales: Fueling Innovation and Philanthropy”:

He has used Amazon stock sales over the years to fund projects and ventures, including his Blue Origin space venture. Bezos also launched the $2 billion Bezos Day One Fund in 2018, which focuses on homeless families and preschool education.

A stock sale of 50 million shares would raise more than $8.5 billion at Amazon’s current share price. The company’s stock closed above $170 per share on Monday.

He has used Amazon stock sales over the years to fund projects and ventures, including his Blue Origin space venture. Bezos also launched the $2 billion Bezos Day One Fund in 2018, which focuses on homeless families and preschool education.

A stock sale of 50 million shares would raise more than $8.5 billion at Amazon’s current share price. The company’s stock closed at over $a hundred and seventy per share on Monday.

Jared Walczak, vice president of state projects at the think tank Tax Foundation, wrote in November that “a Washington state tax official probably broke down in tears” at Bezos’ announcement that he was moving to Miami.

“And whether tax savings motivated his move or not, the implications for Washington are very real, and how dangerous it can be to design tax systems that depend overwhelmingly on a small number of taxpayers who choose to stay.” Walczak wrote.

“Washington State Senator Calls for Wealth Tax to Foster Local Innovation and Growth”:

Washington state Sen. Noel Frame, who sponsored a wealth tax proposal last year, told GeekWire in November that he doesn’t buy the narrative that wealthy people move to avoid paying higher taxes, pointing to research that says otherwise.

Frame says economic competitiveness is not about tax policy but about things like infrastructure investment or public education.

“We should be taxing wealth and reinvesting those dollars in the amenities that attract early-stage entrepreneurs to our state, so they can put down roots and raise their families and build their wealth here,” Frame said. . “That’s what the data tells us. And that’s what [Bezos] did with Amazon.”

Frame says economic competitiveness is not about tax policy but about things like infrastructure investment or public education.

“We should be taxing wealth and reinvesting those dollars in the amenities that attract early-stage entrepreneurs to our state, so they can put down roots and raise their families and build their wealth here,” Frame said. . “That’s what the data tells us. And that’s what [Bezos] did with Amazon.”

Update:

In response to an inquiry from GeekWire this week, Sen. Frame made a statement: “You know, when Bezos moved to Miami, he was clear that his motivation was to be close to his family and to work with Blue Origin. While some conservatives cite capital gains taxes as a motivation, I’ve never heard Bezos say that. Some of these conservative pundits may care more about playing politics than telling the truth. With Amazon stock at such a high price right now, it seems like a logical time for someone to want to sell, regardless of which state’s tax code they live under.

if you lurn more about Jeff Bezos visit the website